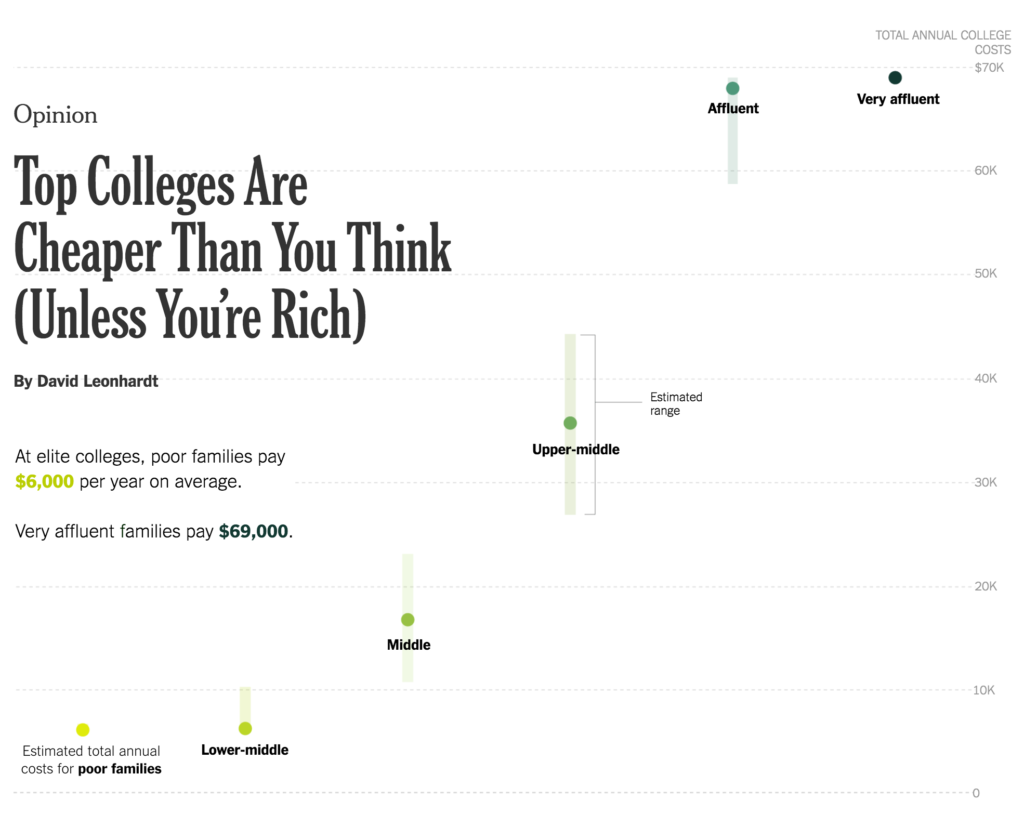

The cost of college is a notoriously complex subject. The list price at many private colleges, including tuition, fees, room and board, has reached the bewildering sum of $70,000 a year. But the real price, taking into account financial aid, is often vastly lower.

How much lower? We’re here to help answer that question.

More than 30 top colleges now participate in a simple online calculator that provides cost estimates to families. (And those 30 typically charge similar prices to other selective colleges.) The New York Times has analyzed the data from the calculator and is publishing the results here. It’s a snapshot of what college really costs.

Typical lower-income students – from a family earning $50,000 or less, for example – face an annual bill of $6,000. Students can often cover that cost through part-time work and a small annual loan, without their parents having to pay additional money.

Middle-class families pay a higher price, but nothing like the list price. Only affluent families pay something close to the list price. It’s true that many of these families don’t think of themselves as affluent. But they are – part of roughly the country’s richest 10 percent, with an annual income of at least $175,000 and a net worth of a half-million dollars or more. For them, a college bill approaching $70,000 can be decidedly unpleasant, yet it doesn’t reorder their lives.

The bottom line is that the cost of college is a serious issue in this country, but not quite in the way that many people think. Colleges with intimidating list prices aren’t the biggest problem, because they often offer substantial financial aid and have very high graduation rates. Low-income students at these colleges certainly don’t have it easy. Many initially struggle to fit in on elite campuses. Yet the vast majority go on to graduate, emerge with manageable amounts of debt and get good jobs.

The real problem is elsewhere: among for-profit colleges and public colleges with lower list prices but much lower graduation rates. They often produce students with debt and no degree, which is a miserable combination.

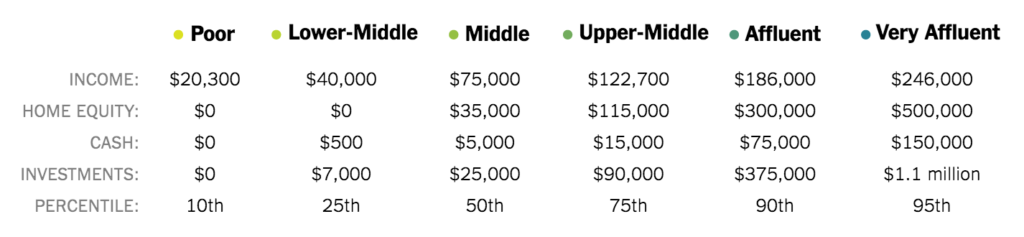

To conduct this exercise, we created six representative families, each with an income and net worth based on the national distribution for families with college-age children.

The middle-class family, for example, earns $75,000 – about the median (or 50th percentile) income for families in this age range – and has a modified net worth of $65,000 – also about the median figure nationwide. The most affluent family has an income at the 95th percentile and a modified net worth at the 95th percentile. (“Modified net worth” excludes retirement accounts, as most colleges do when calculating financial aid.)

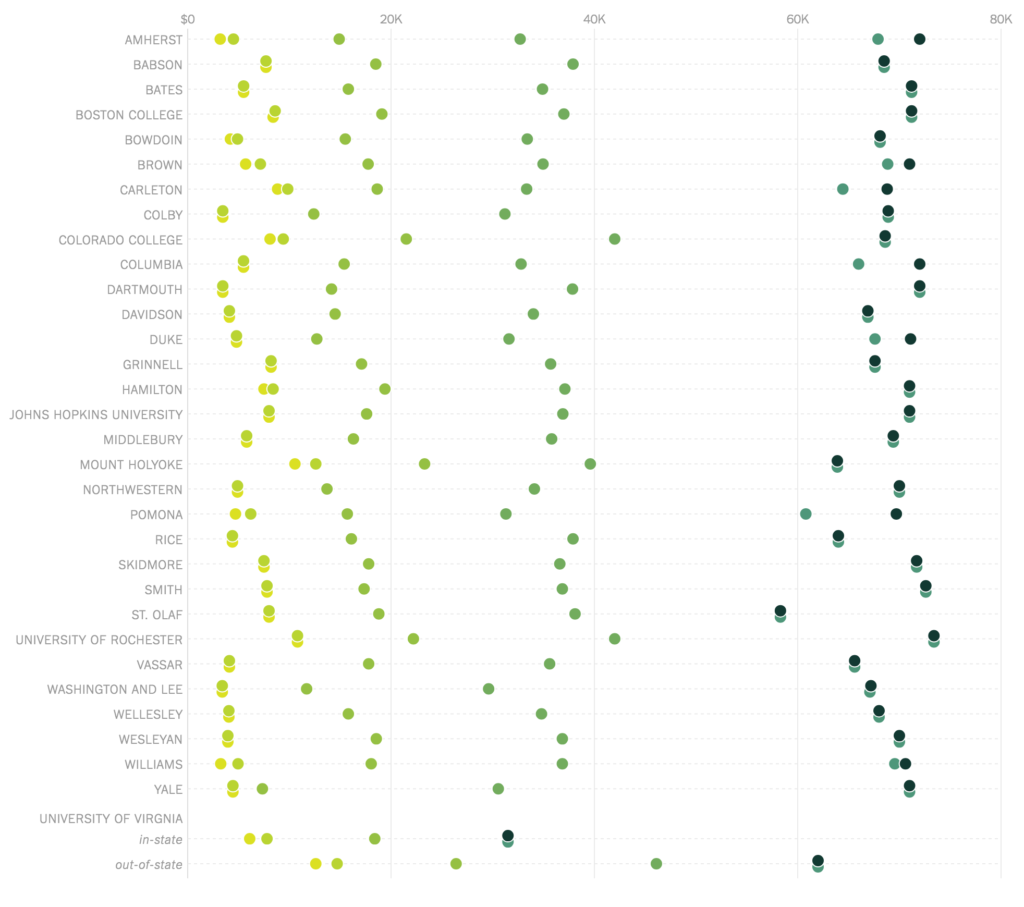

Here is the full breakdown of costs, for each of the six representatives families, at each of the 32 colleges that participate in the online calculator, which is known as MyIntuition. Of the 32, 31 are private. For the one public college, the University of Virginia, we separately show the costs for in-state and out-of-state students.

One striking pattern is the similarity of college costs for a given family across different selective colleges. Prices do vary from one college to another, but often not radically so.

Look, for example, at the Kelly-green dots congregated around $16,000. They depict the total cost of college for a family with median income and wealth. A student from one of these families would typically take a loan of about $2,500 and earn another $5,000 through a summer job and part-time work during the school year. The parents would then owe the remaining $7,500 or so.

That’s a substantial sum for a middle-class family, one that often requires families to dip into savings. Yet it’s also vastly smaller than the often-quoted list price. And given the large economic returns to a college degree, many families understandably decide that the cost is worth it.

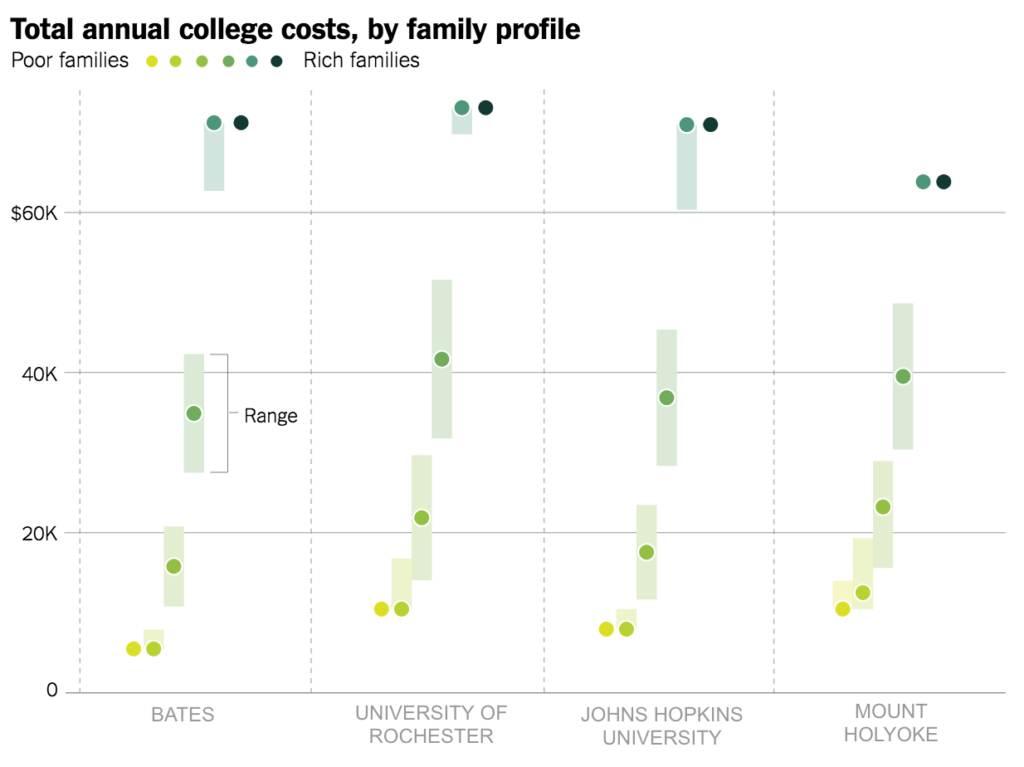

As similar as the costs are from top colleges to the next, they are not identical. Mount Holyoke and the University of Rochester are among those that charge a higher average price to lower- and middle-income students, via both larger student loans and higher parent payments.

Not surprisingly, colleges that charge more tend to have smaller endowments, giving them fewer resources to pay for financial aid. In some cases, these more expensive colleges also enroll a greater portion of low-income students than colleges that charge less – effectively choosing to spread their financial-aid dollars more thinly among a larger group of students. Mount Holyoke and Rochester, for example, have a more economically diverse student body than Bates, Johns Hopkins or Skidmore, each of which charges less on average to the lower-income students they enroll.

Meanwhile, the least expensive selective colleges for poor and middle-class students often have the largest endowments. Amherst, Dartmouth and Williams are all examples. Yale stands out for providing the most financial aid to middle-class students, charging them only slightly more than poor students. (Harvard, Princeton and Stanford, who don’t participate in the online calculator, have similar policies as Yale.) For both poor and middle-class students, these colleges tend to be significantly cheaper than four-year public universities.

For anyone thinking about applying to one of these colleges, it’s important to remember that the numbers here are estimates. We are showing the “best estimate” for each college. The MyIntuition calculator also provides a “high estimate” and a “low estimate” for any student at any college. Often, the range of these estimates overlaps across colleges:

The beauty of the calculator is its simplicity. In about 60 seconds, you can receive an estimate from it. But this simplicity means it can’t take into all of the nuances of a family’s financial situation – which colleges will consider when determining financial aid. Many colleges also give scholarships based on academic record.

Phillip Levine, a Wellesley College economist who created the calculator, emphasizes that people should not rule out a college simply because the calculator makes it looks slightly more expensive than others. Students who need financial aid should apply to multiple colleges and see what aid offers they receive.

We agree with that, and we’ll add another piece of advice: Don’t assume that any college is too expensive for you to attend. For the vast majority of Americans, college – public or private, elite or more typical – doesn’t cost anywhere near $70,000 a year.

You can join me on Twitter (@DLeonhardt) and Facebook. I am also writing a daily email newsletter and invite you to subscribe.

Research by Jeremy Bowers. Graphics by Stuart A. Thompson and Jessia Ma.

Methodology

The six representative families are based on data from the Federal Reserve and Census, compiled in consultation with Phillip Levine, the economist who created MyIntuition. The specific breakdowns of wealth – cash, home equity and non-retirement savings – are estimates based on the overall net-worth data.

The data on college costs are all based on families with only one child in college. Families with more than one child in college at the same time would pay substantially less for each one (as you can see by experimenting with the MyIntuition calculator).

Consistent with colleges’ policies, we assumed that all students would be expected to earn up to $2,000 through a summer job. When telling students about their annual costs, colleges typically fold this $2,000 into a category known as Expected Family Contribution, which consists mostly of parent payment. We instead combined the $2,000 with the money students are expected to earn during the school year through a work-study job. This combined category is called Student Job.

All averages apply to only the 31 private colleges and exclude the University of Virginia. In the first chart in this article, the range of costs is based on the average “low estimate” and the average “high estimate” across all colleges.

By David Leonhardt

As seen: https://www.nytimes.com/interactive/2018/06/05/opinion/columnists/what-college-really-costs.html